Calculate Your 1099 Contractor SETC/FFCRA Tax Credits in 5 Easy Steps

Introduction

If you're a 1099 contractor who faced COVID-19 related disruptions in 2021, you could still be eligible for valuable tax credits. The SETC and FFCRA tax credits were designed to help self-employed individuals who needed to take time off due to their own illness, quarantine, or family care obligations related to the pandemic. Let's see if you qualify and estimate your potential refund!

Who's Eligible as a 1099 Contractor?

You might be eligible for these credits if you:

- Worked as an independent contractor, freelancer, sole proprietor, or gig worker.

- Had to take time off work in 2021 due to your own COVID-19 illness or quarantine.

- Missed work in 2021 to care for a family member with COVID-19.

- Lost work in 2021 due to COVID-19 related childcare issues.

Important Note: The deadline to claim credits for the 2020 tax year has passed, but you can still claim up to $16,100 for 2021.

Step-by-Step Guide

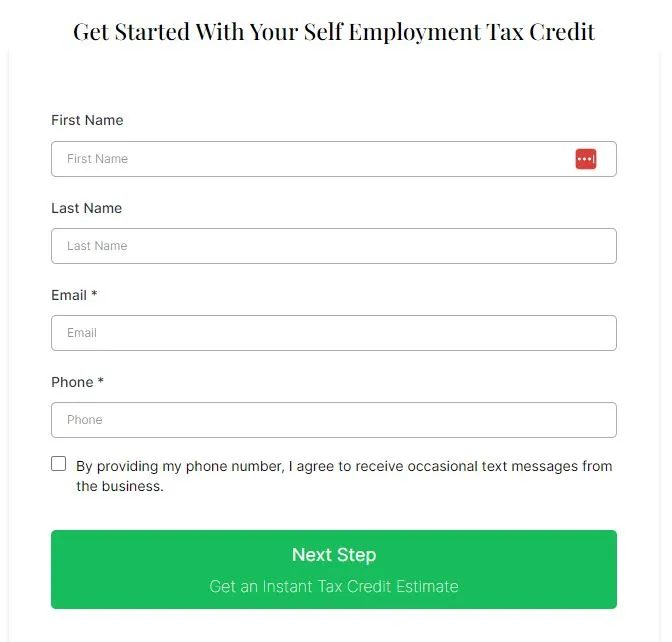

1. Get Started:

Click here and enter your name, email, and phone number. The form looks like this:

2. Input Your 2021 Income: Enter your income from the 2021 tax year.

3. Enter Your Time Off: Include the number of days you missed work due to your own COVID-19 related reasons and the number of days for family caregiving.

4. Calculate and Consult: The calculator will provide an estimate. Schedule a free appointment with an SETC expert for personalized help.

5. File and Receive: The tax consultant will help you file the necessary paperwork and the IRS will process your refund.

Example

Let's say you earned $80,000 in 2021, took 10 days off for your own COVID-19 illness, and missed 61 days for childcare due to COVID-related closures.

You could potentially qualify for a substantial tax credit!

Conclusion

Don't leave money on the table! Use the calculator to quickly estimate your SETC/FFCRA tax credits for 2021. Their experts can help you maximize your refund.

FAQs

- Is there a deadline to claim? Yes. Generally, you must file amended tax returns within three years of the original filing deadline. For 2020 credits, the deadline was April 15, 2024. For 2021 credits, the deadline is April 15, 2025.

- What if I'm not sure I qualify? Our partner's experts can assess your specific situation for free.

- How long does it take to get my refund? Processing times vary, but consulting with our partner organization can help streamline the process.